Discovery of green and social projects with impact-oriented outcomes

Introduction

Sustainable finance and investments experience unprecedented levels of customer demand with ESG funds increased 15% in 2020. Experts estimate growth of more than 30% till 2025 of all assets under management. Financial providers are investing into intensive product development with 330 new ESG funds created only last year. And while climate accounts for about 20% of new ESG funds launched in 2020, experts forecast a growing role of social issues (‘S’ in ESG abbreviation).

These money inflows on financial markets support new levels of demand for ESG projects. Green bonds market launched in 2013 from $3bn and then effectively doubled each year. When pandemic first hit economy and society, large-scale effects became evident in spring last year, there were speculations of reducing demand for ESG. But instead, the market experienced unprecedented growth. Green bond issuance hit $279bn in 2020. Sustainable bonds and sustainable loans market last year increased 72% reaching $742bil. Overall, the green and social bonds market topped $2tr in 2020.

EU areas (including the UK) are in dominant positions leading this growth. Both EU and UK regulators accelerated adoption of regulatory requirements for both asset managers and investors. Growing number of countries are making Net Zero commitments while more than 60 global banks introduced financial restrictions on fossil fuels financing. Another important development is a rise of shareholder activism focusing on ESG topics.

Problem statement

In this environment investors are increasingly looking for opportunities to finance ESG projects. The challenge for the corporations is to identify appropriate projects with measurable impact-oriented outcomes that fits well with sustainable finance opportunities. There are some hurdles to overcome. For example, industry associations like ICMA recommend clearly identifying environmental and social objectives and high levels of transparency for project selection and evaluation to satisfy its Green Bond and Sustainable Bond principles. Similar requirements usually apply at the burgeoning sustainable loans sector.

Sample consulting projects include climate risk adaptation and transition, physical risk mitigation, energy transition, social issues projects (product quality, improved labour management, etc.)

Sustainable finance (sustainable loans, sustainable bonds, etc.) can provide access to reduced yields or interest rates compared to the mainstream alternatives and that can constitute a key advantage for the customer. Other customer benefits include better compliance or overcompliance with existing and emerging regulatory requirements, better positioning at consumer and labour markets, potentially higher ESG rating and in some cases credit rating, improved relationships with investors, particularly ESG-oriented active stakeholders.

There is one important possibility for multinational corporations. In a contrast to equity products, some types of structured (green / social) fixed income products may be attached to a separate subsidiaries or projects within the diversified organization.

Project approach

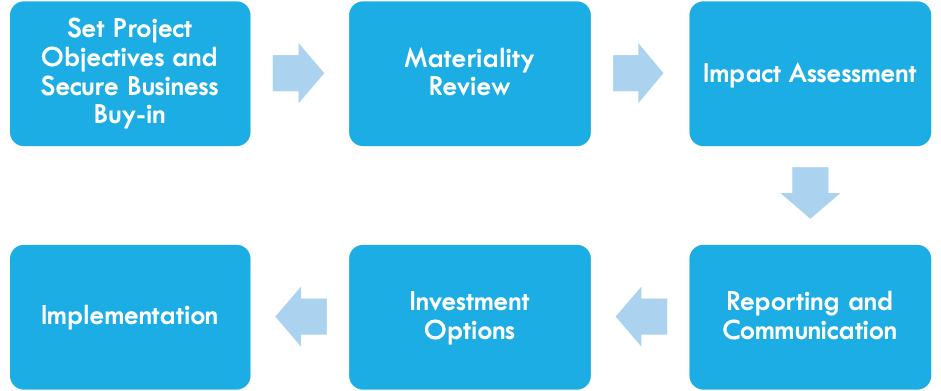

The green and social project discovery might be conducted by the corporation internally or with the support of the specialized consulting company. Overall project structure is illustrated at the diagram below.

The project starts with conducting review of material factors and scenario analysis building ESG heatmap and short list of projects. Then the team creates impact assessment for identified projects and defines a framework of impact metrics, measures and performance scorecards. Next step is to establish a reporting process and communication of impact measurements, aligning them with overarching corporate disclosures and quality assurance procedures. The project culminates with market review and selection of the optimal project financing option linking impact-oriented measures.