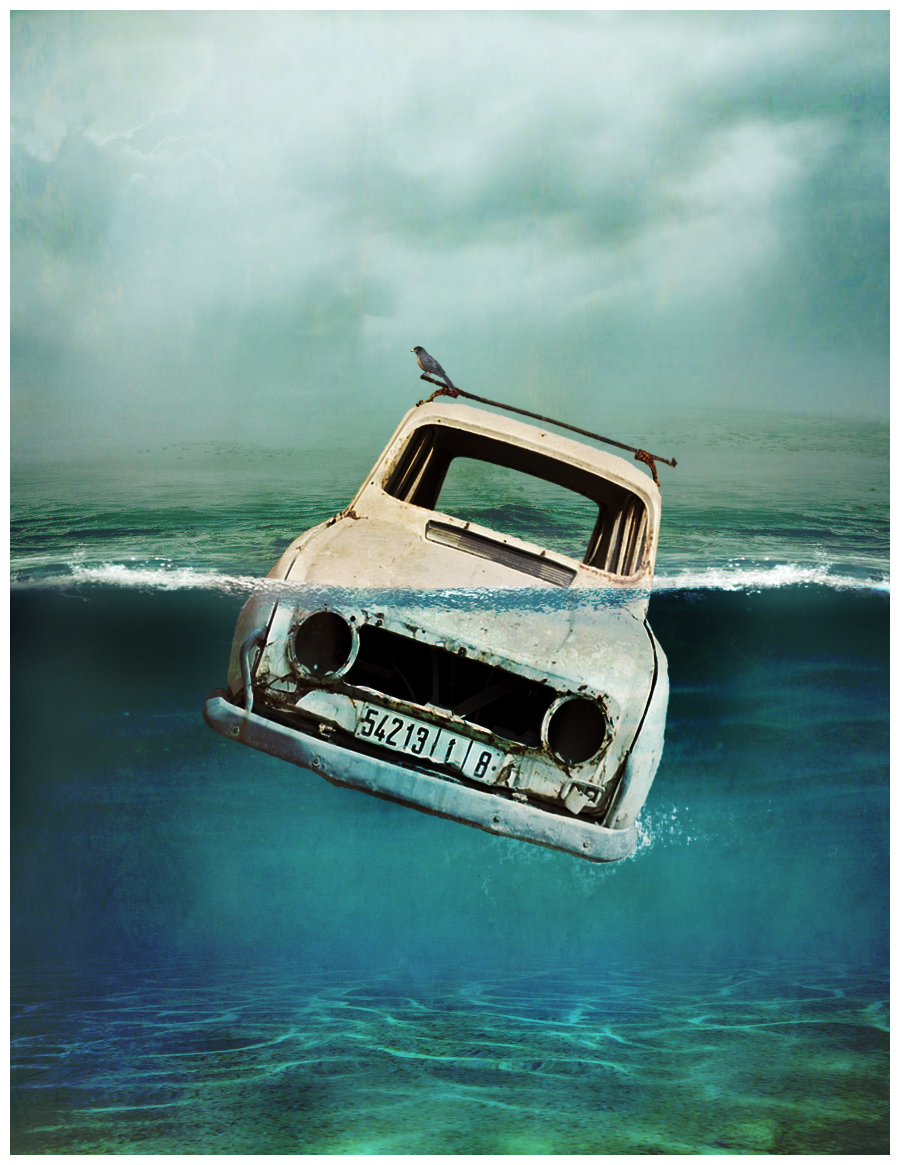

The biggest hurdle to halt climate change

The biggest hurdle to halt climate change? It’s people. The leaders and practitioners hold diverse views. Especially how to overcome certain established or preformed ideas.

Transition from internal combustion engines (ICE) to electric vehicles (EV) may disrupt the business model of the banks active in the automotive sector financing. It’s challenging to foresee residual values of EVs on the second-hand market a few years down the road. That makes the risk management existentially tricky.

A few projections are available to fuel the discussion. Evolution of the UK automotive market may follow a range of scenarios resulting in EV market penetration from 10,4% to 34.7% in 2030. Market watches the UK making important commitments. One of them will stop new registrations of ICE passenger cars in 2030.

Unusually intense feelings and views are about what will happen. It’s less about data and more about convictions. A lot of arguments are expressed that EV prices are artificially elevated by subsidies and luxury BMW costs twice less than comparable Tesla. That EVs have too many practical limitations – price, performance, range, charging. And if you don’t have a driveway to install a charging point, there are no reasons for EV.

A specific viewpoint is that current success of EVs is limited to early adopters misled by zero-emission marketing claims for EVs, and wider adoption will struggle to follow. Slightly unusual is to hear the “younger generation” have not developed a luxury lifestyle and can be persuaded to use public transport or alternative mobility like bikes or scooters, while “older generation” (which is curiously “we” in dominant number of discussions) with ease absorb higher prices for fossil fuels and energy. I would argue developers of any potential carbon tax may need to link it to tax brackets scale.

Remarkable conviction is ICE vehicles deliver so many advantages over EVs that a great share of customers will wait till 2029 to purchase the latest available new ICE vehicles (someone asserted not to call ICE old – they are “classic”). And I heard a strong rebuke – it’s not for the banks to guide the EV automotive market, they are all about financial stability.

I admit some arguments I’m buying. It may be impossible to resell a recent EV in 3-5 years without loss. There’ll be more efficient and cheaper EVs. There may be times when producing new EV will generate more pollution than extended use of ICE cars. Change in UK electricity (more oil & gas or nuclear generation) and research on battery manufacturing may worsen calculations for EVs.

I would like to finish on a promising note. Dramatic shift in mood occurred between January and late March. Petrol prices above £3 per litre suddenly in a realm of possibility. Zero-emission zone in Oxford moved policy outside London. Notably, there was the revelation that it may be feasible to see 30% of the loan book in EVs financing. Fingers crossed, that will happen.